According to an Accenture survey, over 75% of consumers are more likely to purchase from retailers who know their name and buying preferences, and about 52% of them are more inclined to change brands if the company does not offer personalized experiences.

Data is a crucial asset for retailers. It is used in the world of retail for many reasons – from operations to analytics. Knowing the exact address of your customer to ensure successful product deliveries, as well as understanding market and consumer trends to plan inventory – it is only possible with reliable and accurate data. But data is not always perfect. In fact, it has quite a lot of quality issues – something that can backfire and raise more problems than provide solutions.

This whitepaper comprehensively discusses the role of clean data in the retail industry, how retailers can identify if they have poor retail data quality, the most common issues associated with data in retail and how to fix them.

Let’s get started.

The Role of Clean Data in Retail

Nowadays, consumers have a large number of options while making a purchase, but they often end up preferring one brand over the other. This choice is influenced by a number of factors, such as accurate product recommendations, timely delivery, better pricing rates, and product availability. Most retailers cite data to be their most important organizational asset and believe it to be the main fuel that drives crucial factors such as listed above.

Let’s look at such factors, and the role data plays in enabling them.

1. Offering Accurate Product Recommendations

If you’re a retail brand, then you want to sell more to your store visitors or existing customers. A very

common and effective way to do that is by displaying product recommendations. These recommendations are based on products that are:

Usually bought together,

Usually bought together, Similar in nature,

Similar in nature, Recently purchased by customers with similar demographics,

Recently purchased by customers with similar demographics, Recently viewed by that visitor, and so on.

Recently viewed by that visitor, and so on.

Accurate data analysis in the retail industry is only possible if you have reliable data, such as

capturing the exact number and types of interactions customers have with your brand across

multiple touchpoints. Similarly, these recommendations also rely on the accuracy of your product

descriptions, since you cannot identify the correct relationship between two products if the data

used to compare them is incorrect.

2. Ensuring Timely Product Deliveries

Nothing makes a customer happier than a package delivered to the right address at the right time without any delay. But for retailers, this is probably one of the biggest headaches. The ambiguity or inaccuracy of a retailer’s customer contact dataset makes it almost impossible to deliver packages to the right address.

Retailers usually treat their address datasets to address standardization and address verification techniques to ensure that each customer address specifies a physical, mailable location. Standardized and verified datasets help retailers to ensure products are delivered to the customer’s doorstep at the right time.

3. Predicting Consumer Behavior and Trends to Plan Assortment

Assortment planning focuses on choosing the right breadth (product categories) and depth (product variation within each category) for your retail store at a given time, keeping consumer behavior and market trends in mind. Assortment planning is not something that is generalized for your entire retail brand, rather it is specific to the store and region of your outlet.

The success of any retail store or brand depends on the strength of their assortment, and assortment is best planned by performing trend analysis on past data about consumer behavior and market demand. Major retailers use advanced retail analytics tools that gather not just their own but their competitors’ data as well at different locations – in-store and online. But data captured in this way – from a number of scattered sources and vendors – is not present in the most optimal form and shape to be used for analysis. Basing the decisions of your assortment on bad data can cause a retailer to lose a lot of time and money. And so, the quality of data used to plan inventory is another important aspect to consider.

4. Leveraging Personalized Customer Experiences

The best way to offer personalized experiences to your customers is by first understanding:

What are they interested in?

What are they interested in? What do they buy and why do they buy it?

What do they buy and why do they buy it? Who are your customers (including the correct and accurate information about their demographics)?

Who are your customers (including the correct and accurate information about their demographics)?

Knowing your customer in terms of their demographics, preferences, and shopping behavior, can help a retailer to brand experiences that speak to a specific customer segment. This is possible when retailers have accurate and unique data about each customer.

Since consumers interact with brands through different channels, retailers mostly have multiple records for the same individual. Such scenarios must be handled by integrating and unifying data at one place, and making sure that the entire organization references the single source of truth for all intended purposes. These efforts do not only allow retailers to offer personalized communication but also enable omnichannel experiences for their customers (across in-store, e-commerce websites, or social media platforms) – no matter where the customer is on their buying journey.

5. Establishing Competitive Pricing

Competitive pricing is all about collecting the price points set by your competitors for a certain product category and comparing them against your own price points for the same category. This analysis helps you to establish competitively better prices for your products and make sure that you are not losing customers to competitors based on unrealistic price differences.

6. Identifying Cross-selling Opportunities

This is another aspect of using market data analytics. Upselling means selling similar but more feature rich products to your customers as compared to the ones they are buying. Cross-selling means selling additional products to your customers depending on what is usually bought together. Both these phenomena can help a retailer to sell more to an existing customer.

Retailers usually take advantage of these cases by offering promotional deals where similar or contrasting products are sold together. But this is only possible by using accurate product as well as sales information, and performing successful analysis to find out products that are used together, or in place of each other.

Indicators of Poor Data

Quality for Retailers

The role of clean, quality data in the world of retail is fairly obvious. Retailers want to ensure that their customer, product, location, and other datasets have acceptable levels of quality. But the reality is that these datasets mostly have hidden data quality issues that may not be clearly visible. Brands often experience a number of data challenges in retail that occur as a result of poor data quality.

In this section, we will look at some common problems faced by retailers that actually indicate bad data quality. together. But this is only possible by using accurate product as well as sales information, and performing successful analysis to find out products that are used together, or in place of each other.

| Indicators of Poor Data Quality for Retailers | |

|---|---|

| High Product Return Rates | Retailers with poor-quality datasets experience higher product return rates. Most products are returned due to deliveries being made to the wrong address or wrong products being delivered to the right address; both these cases are signs of inaccurate or unreliable data being used to showcase or deliver products. |

| Lack of Customer Personalization | Another indicator of poor data quality for retailers is their struggle to offer personalized experiences to their customers across different channels. This often comes up in different forms, such as the same promotional email being sent multiple times to a customer, or being unable to identify a customer’s preferences and suggest products accordingly. |

| Phantom Inventory or Stockouts | Phantom inventory refers to retail goods that are recorded or displayed as being available but are not present in inventory. Similarly, phantom stockout refers to retail goods being out of stock when they are available. Both scenarios happen due to the incorrect or inaccurate information present in products or sales datasets. This can lead your e-commerce website to show an available item as out of stock or vice versa. |

| Price Inaccuracy | Do your potential customers buy from competitors just because they offer products at slightly lower rates? Or are you winning customers over by showcasing the same products at considerably lower price rates? Both these situations are a sign of poor pricing strategy and the inability to use data to make better pricing decisions. |

| Inefficient Inventory Planning | Inventory planning depends on multiple factors, such as market demand and customer requirements. When retailers fail to plan their inventory effectively, there is a high chance that the datasets used to forecast and estimate inventory requirements are not reliable and accurate. |

| Reduced Market Share | Are you selling less as compared to other competitors in the same market? There can be many reasons for this, but a common problem faced by retailers in such cases is being unable to perform whitespace analysis or uncover hidden market opportunities by using reliable data insights. This may be encountered in the form of reduced sales, losing money, or a decreasing market share in the industry. |

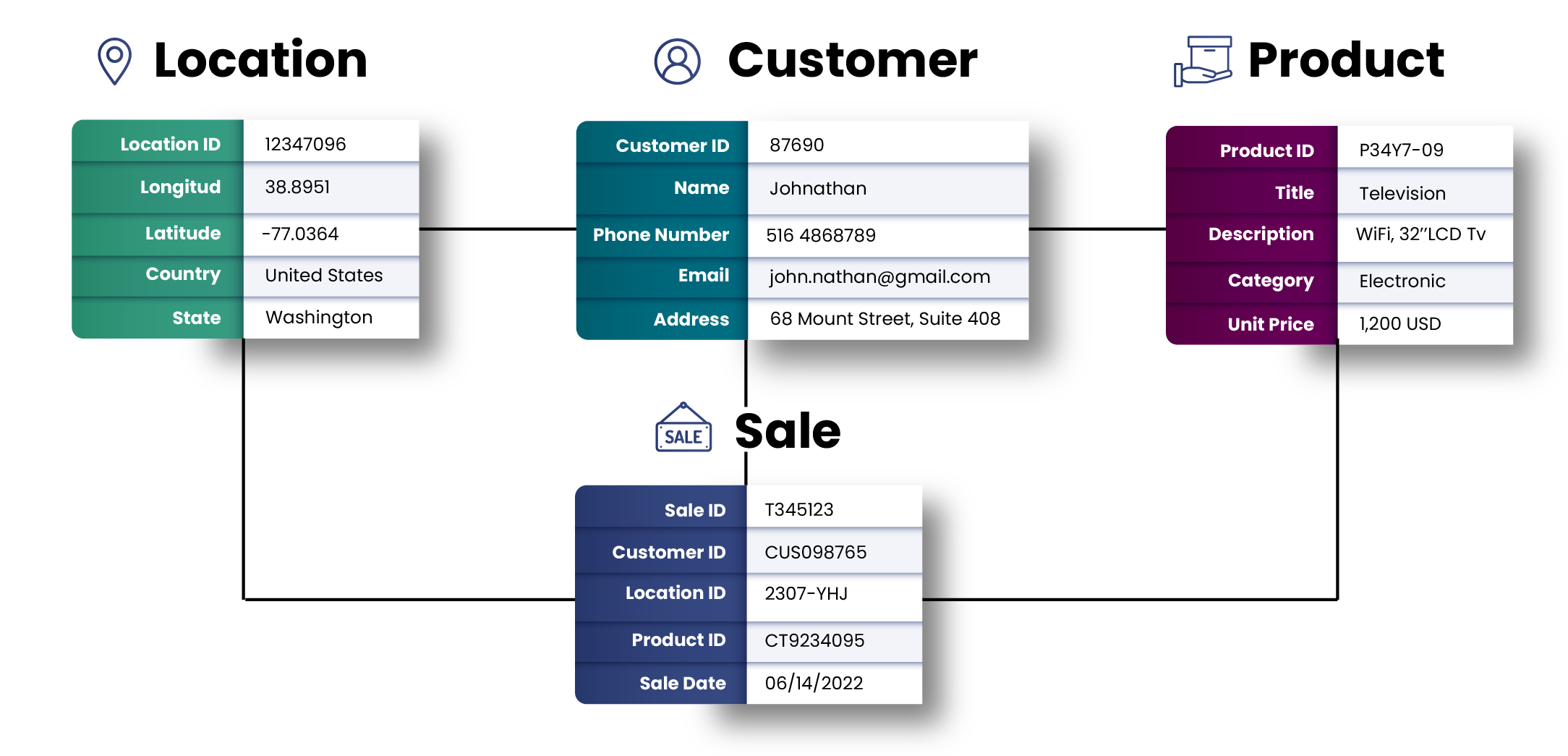

What are Master Data Assets in Retail?

Every retail company utilizes a number of data assets to ensure successful operation of their business processes and transactions. They may differ depending on the type of company, but generally for a retail company, these include datasets for customers, prospects, leads, vendors, suppliers, products, locations, employees, stores, and so on. A few of them are considered to be master data assets since they are crucial for successful retail operation while the rest are somehow related to the master ones (either due to the similarity in meaning or data model). There are four main data assets that are used in almost every retail transaction, namely, customer, product, location, and sales.

Example of Retail Master Data

As an example, consider the most common transaction that a retailer processes a number of times daily:

Customer A buys Product B from Location C

This transaction in itself is considered a sales record. For this transaction to be true, accurate, and reliable for use in any intended purpose, there must be a:

Customer A in the customer dataset,

Customer A in the customer dataset, Product B in the product dataset, and

Product B in the product dataset, and Location C in the location dataset.

Location C in the location dataset.

Before we move on, take a look at a basic retail data model shown below:

Common Data Quality Issues in Retail Datasets and How to Fix Them

We discussed how data quality issues can cause irreversible damage to a retailer – including the impact on sales revenue, customer relationships, as well as brand reputation. Furthermore, we also looked at what master data is in the retail industry. In this section, we will try to see what poor data quality looks like in retail data, and what you can do to fix retail data quality issues.

Here, we will only focus on the data quality issues present in the four data assets mentioned above, that is, customer, product, location, and sales. This will help you to identify problems in other, similar datasets, for example, problems in the customer dataset are similar to the ones present in prospects, leads, suppliers, vendors, etc. Likewise, location datasets will have similar problems to store datasets, and so on.

Another thing to note here is that we will try to look at the issues that are specific to that type of data asset and not general data quality issues that are commonly found across all datasets. For that, we recently covered 12 most common data quality issues and where do they come from in our previous blog.

1. Customer

Customer information is one of the biggest assets for any organization. This is why businesses cannot afford to have missing,

incorrect, or incomplete data in their customer datasets. But since customers interact with a brand across multiple channels, it is often the first place where discrepancies in data quality are detected. Let’s look at the three most common data quality issues faced by retailers in their customer datasets.

a. Duplicate Customer Records

What is it?

All interactions that a customer has with your brand during their buying journey are recorded somewhere in a database. These records may be coming from websites, landing page forms, social media advertising, sales records, billing records, marketing records, purchase point records, and other such areas. If there’s no systematic way of identifying customer identities and merging new information with existing ones, you can end up with duplicates throughout your datasets.

It gets pretty difficult to track duplicates and identify the ones that belong to the same customer – especially if the data being captured is inconsistent across all channels, or there are obvious typos or variations present in duplicate records. As a result, you may end up sending the same email to a customer multiple times, or your team may experience problems while choosing one record for a customer that shows correct, up-to-date information about their phone number or address.

How to fix it?

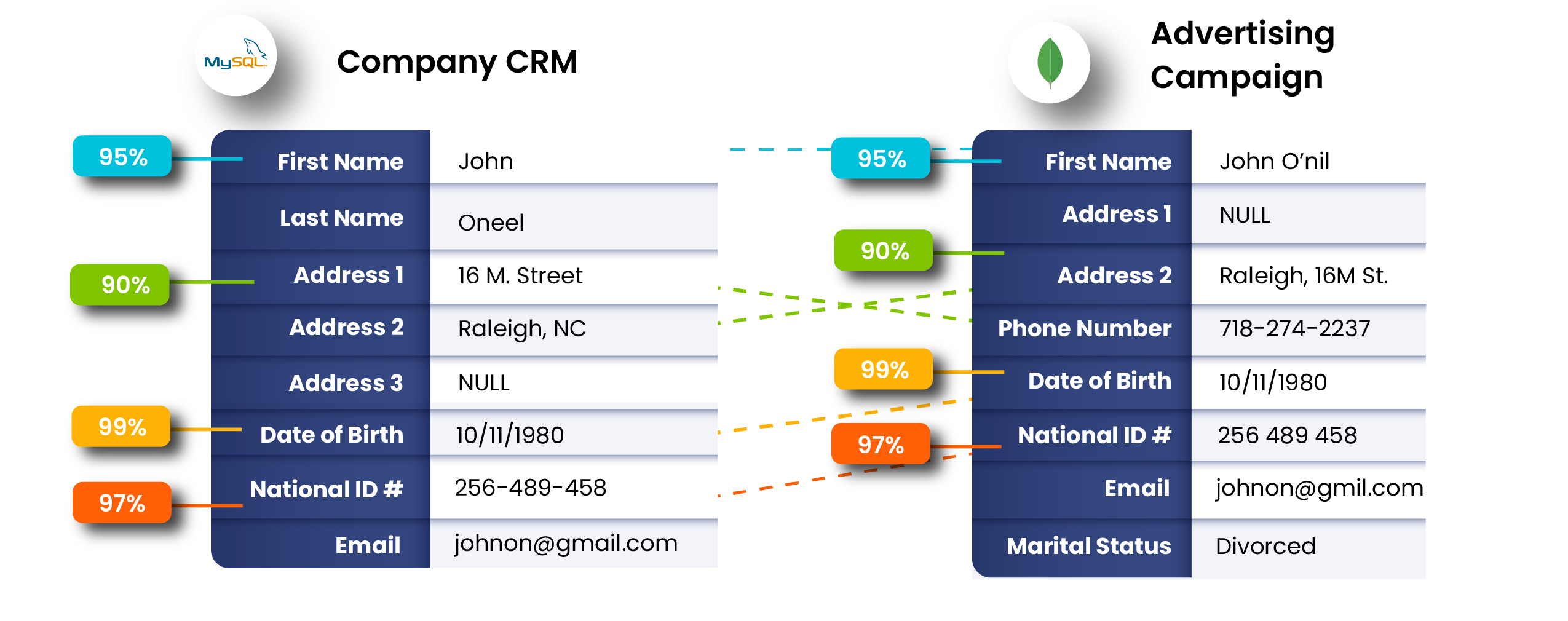

To fix duplication, you will need to run advanced data matching algorithms that compare two or more records and calculate the likelihood of them belonging to the same customer. Sometimes, this comparison can be run using only one customer attribute (such as Social Security Number). In the absence of unique attributes, you will need to execute fuzzy matching on a combination of fields – such as using Customer Name, Residential Address, and Phone Number together.

It gets pretty difficult to track duplicates and identify the ones that belong to the same customer – especially if the data being captured is inconsistent across all channels, or there are obvious typos or variations present in duplicate records. As a result, you may end up sending the same email to a customer multiple times, or your team may experience problems while choosing one record for a customer that shows correct, up-to-date information about their phone number or address.

Read more at The duplicate data dread – A guide to data deduplication.

b. Lack if 360 Customer View

What is it?

An average organization with 200-500 employees uses about 123 SaaS applications these days. The vast number and variety of applications used to capture, manage, store, and use data is the main reason behind a customer’s information being scattered across sources. As a result, retailers fail to perform important statistical analysis that is needed to make better decisions, such as accurate marketing attribution or lead attribution.

A lack of 360 customer view may hinder your efforts to understand customer behavior and preferences, as well as offer smooth customer experiences.

How to fix it?

Deduplicating customer records mainly focuses on choosing one record of a customer and discarding others. On the other hand, enriching data to obtain a 360-customer view focuses on getting all data you have about a customer together, and inferring important meanings from that grouped information.

This is usually carried out through advanced data merge and survivorship rules in addition to data matching techniques. During data enrichment, you can define the kinds of interactions to retain in a customer’s record, and also create a golden record that acts as a single source of truth for everyone at the organization.

Read more at Your complete guide to obtaining a 360 customer view.